Recovery rebate credit 2020 calculator

Before beginning work make sure you qualify for this rebate by reviewing the Program Rebate Requirements as outlined in the terms and conditions. The credit is available to those who did not receive the Economic Impact Payments or who received less than the full amount that they were eligible for.

Recovery Rebate Credit Worksheet Explained Support

Foreign tax credit Form 1116 is required Check to allow Child and dependent care expenses for dependents Education credits Retirement savings contributions credit 2000 per TPSP Child and Family Tax Credit.

. 2014 Customer Choice annual general meeting. All these were advance payments of the credit. If your 2020 return was filed andor processed after the IRS sent you a third stimulus check but before December 1 2021 the IRS sent you a second plus-up payment for the difference between.

What is the Recovery Rebate Credit. Name State Territory Category PolicyIncentive Type Created Last Updated. If reversed you will need to claim the Recovery Rebate Credit on your 2020 or 2021 return depending on what EIP payment in reference if eligible.

Any eligible individual who did not receive the full amount of the recovery rebate as an. Fill in the step-by-step questions and your tax return is calculated. File 2019 Tax Return.

Are Economic Impact Payments Time Limited. My Adjusted Gross Income AGI was below 150K married filed jointly and still received an IRA Notice CP11 saying that I owe the RRC back 1400. Then you will claim a Recovery Rebate Credit on your 2020 tax return.

If you are claiming a 2021 Recovery Rebate Credit you will need the total amount of your third Economic Impact payment and any plus up payments to file your return accurately and avoid a. Replace your old natural gas furnace with an eligible ENERGY STAR model and you could qualify for a rebate of up to 1000Plus if you install an eligible connected thermostat you could qualify for an additional 150 rebate. If you didnt get it you can still apply for it retroactively as a tax credit on your 2020 tax return.

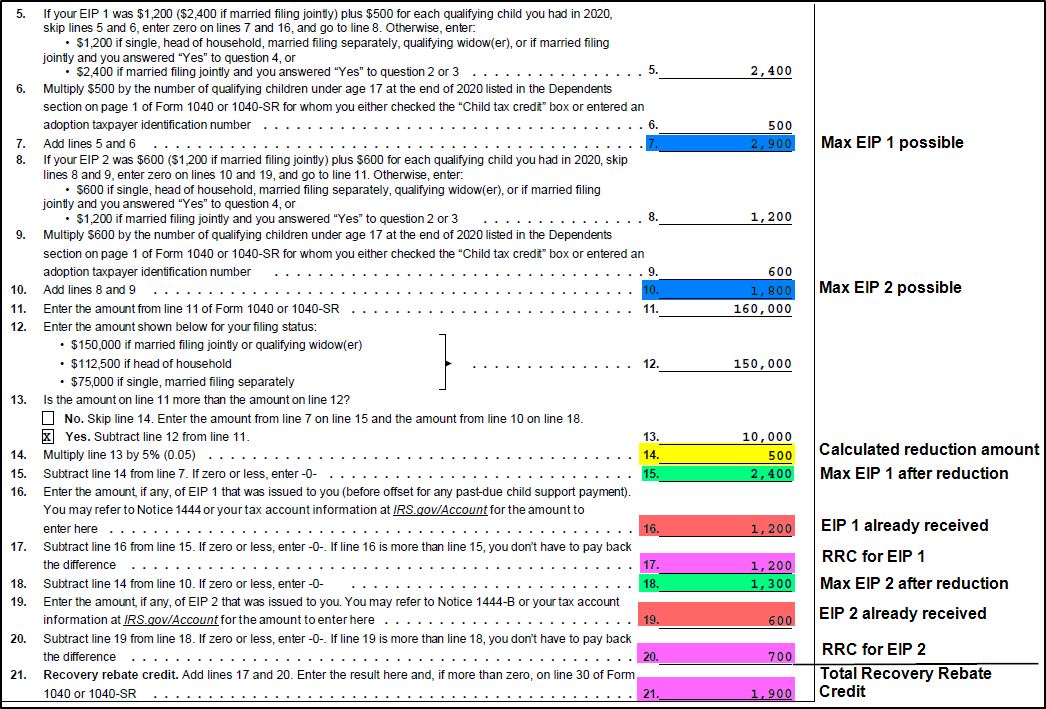

File 2020 Tax Return. Stimulus payments are no longer being issued but the information below is how the Recovery Rebate Credit is calculated. Taxpayers who do not automatically.

All Prior Year Software. The payments will be based on 2020 AGI if a taxpayer has already filed tax returns for last year. However people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Print Prior Year Return. 2020 Biomethane Energy Recovery Charge BERC Rate Methodology G-133-16 Assessment Report. If your 20 Tax Return Filing Status wasis Single and your AGI or Adjusted Gross Income was below 75000.

The 2021 credit is only stimulus three. The notice even confirms my AGI as. Federal tax return at least once for tax years 2018 2019 and 2020 your ITIN will expire on December 31 2021.

Claiming the recovery rebate credit. Learn how our tips and rebate programs can help you conserve energy and save money on high-efficiency equipment for your home or business. The IRS does acknowledge that a small number of taxpayers may be required to file a tax return but have failed to do so for 2018 and 2019.

Taxation credit score You may be eligible to claim the recovery rebate credit if you have lost income due to an economic impact and have a modified AGI for 2020. Americans with very low 2020 AGI or Adjusted Gross income are encouraged to file a 2020 tax return to also take advantage. The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit.

The government sent payments beginning in April of 2020 and a second round beginning in late December of 2020 and into 2021. If you did not receive your third stimulus check this is to be claimed on your 2021 Tax Return as the Recovery Rebate Credit or RRCThis refundable tax credit was introduced in 2020 and was composed of stimulus one and two. This is line 30 of your.

Securely access your IRS online account to view the total of your first second and third Economic Impact Payment amounts under the Tax Records page. To receive payment taxpayers are required to file tax returns as soon as possible in order to ensure they receive their stimulus checks. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

The Treasury Departments Bureau of the Fiscal Service will review your claim and the signature on the canceled check before determining whether the payment can be reversed. If your ITIN wasnt included on a US. Explore personal finance topics including credit cards investments identity.

In order to qualify you must have earned less than 75000 during the year. This way you can report. Tax amount after credits.

2016 Customer Choice program cost recovery application. File 2017 Tax Return. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file.

Best online tax calculator. Residential energy and other credits. Claim your 2021 Recovery Rebate Credit when you prepare your 2021.

Estimate your 2021 taxes. File 2018 Tax Return. Estimate your tax refund with HR Blocks free income tax calculator.

If you didnt get the full amount you were owed you may be able to apply for the Recovery Rebate Credit. You can still claim the credit if you lost income because of a job loss or change. I tried to call the IRS 800 number several times but due to call volume.

2021-24 the IRS clarified how individuals who are not otherwise required to file 2020 federal income tax returns can claim advance child tax credit CTC payments as well as stimulus payments ie third-round economic impact payments 2020 recovery rebate credit payments and additional 2020 recovery rebate credit payments.

How Much Money You Ll Get From The 2020 Coronavirus Recovery Rebate

How Much Money You Ll Get From The 2020 Coronavirus Recovery Rebate

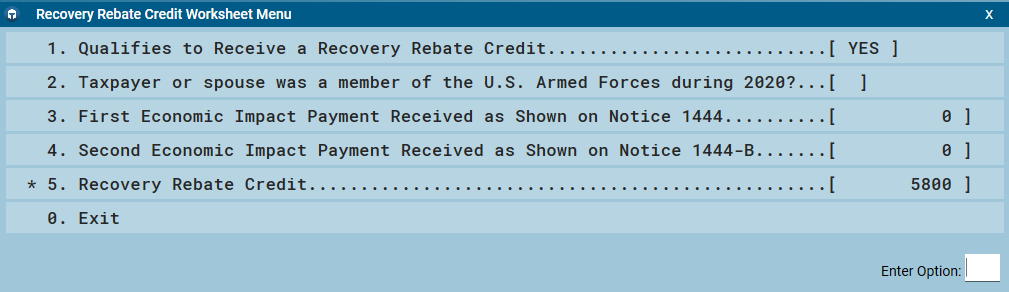

Desktop 2020 Recovery Rebate Credit Support

2020 Recovery Rebate Credit Topic G Correcting Issues After The 2020 Tax Return Is Filed Nstp

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit How Much Can I Claim For 2021 Melton Melton

Expect Refund Delays If You Claimed The Recovery Rebate Credit On Your 2020 Tax Return Donovan

Recovery Rebate Credit 2022 Eligibility Calculator How To Claim

Recovery Rebate Credit 2021 2022 Credits Zrivo

Ready T Use Adoption Tax Credit 2021 Calculator Msofficegeek

Recovery Rebate Credit Worksheet Explained Support

Ready To Use Recovery Rebate Credit 2021 Worksheet Msofficegeek

Missed Stimulus Check Deadline Don T Worry You Can Still Claim It As A Credit Here Is How Internal Revenue Code Simplified

Recovery Rebate Credit H R Block

Irs Cp 12r Recovery Rebate Credit Overpayment

Recovery Rebate Credit 2021 Tax Return

Missed Stimulus Check Deadline Don T Worry You Can Still Claim It As A Credit Here Is How Internal Revenue Code Simplified